Malls have been an iconic thing in Filipino culture. However, in recent years, malls have faced stiff competition, both with each other and with e-commerce. In turn, many brands have tried updating their media efforts to keep up with the latest trends. Here’s a recap of the Philippine retail industry’s news and efforts in 2019:

Retail vs E-Commerce

The widespread success of the 11/11 campaigns by e-commerce giants last year carried over to 2019. People are now looking forward to monthly discounts from the apps. According to the Global Digital Report, about 70% of Filipinos have purchased a product or service online this year. Among them, branded shoes, dresses, and accessories are the most-searched items.

However, this doesn’t mean that retail is lagging behind. Department stores have actually boosted their sales with 6% growth, according to Euromonitor. This increase happened due to new mall openings and initiatives that offer a broader range of international products.

Retail Landscape

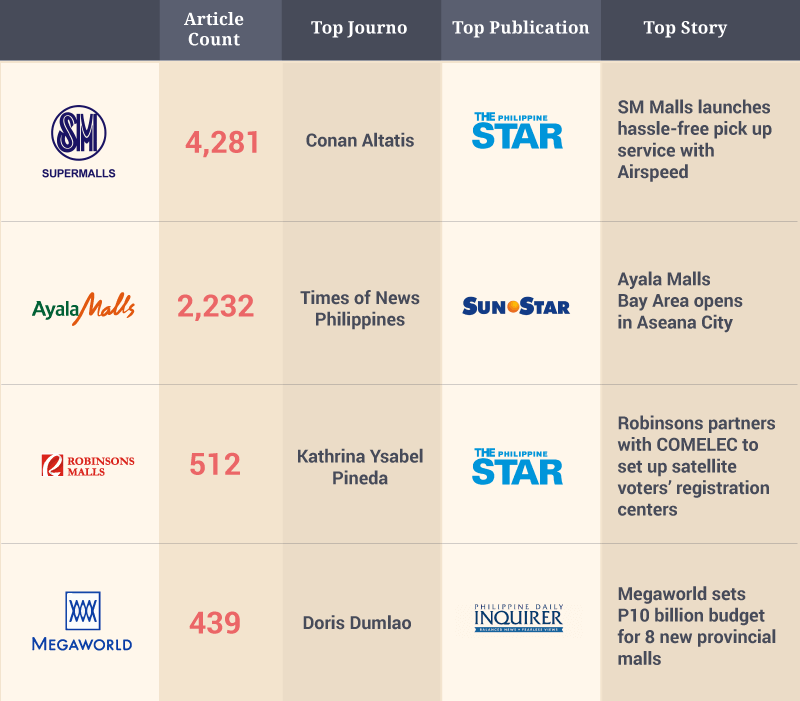

The Philippines is home to one of the largest malls in the world. Each one has its own campaigns and efforts to invite people to visit their premises. Below is the media performance of local retail giants for the months of January to November 2019:

The top 4 retail giants had consistent publicity throughout the year, with SM Malls leading in terms of volume. Each had different focus areas for their expansions and campaigns. These kinds of initiatives are picked up by journalists often because they relay what’s in store for brands to the public.

In relation to that, you can improve future campaigns by knowing what works and what doesn’t. Measure your campaign’s ROI by constantly monitoring the media performance of your campaigns.

ALSO READ: Digitization of the Retail Industry

Philippine Retail Industry 2020 Trends

The retail industry is fast-changing, especially with e-commerce in the picture. Here are the upcoming trends for retail in 2020. Be sure that you won’t miss them out:

Cashless Payments and Convenience

Malls have been an integral part of the Filipino culture. The increased convenience provided by online shopping, however, has made consumers demand the same for malls. Several retailers have already tried to address this challenge. For example, SM Department Store and Robinsons have partnered with FinTech companies such as GCash and Paymaya to provide a seamless payment system. On the other hand, Rustan’s launched its own app for an easy-access mobile loyalty program.

Gen Z and Sustainable Practices

More and more retailers are trying to understand and market to Gen Z as their purchasing power increases. In just this year alone, the age group has spent $143 billion globally.

This generation, specifically, looks for brands that are aligned with their own values. According to Greenmatch, 72% of Gen Z prefer to buy from brands that promote sustainability. The best example for an initiative done by a local mall was the SM by the Bay Coastal Cleanup. Organized by the retail giant, it drew massive publicity and around 11 thousand volunteers to help cleanup Manila Bay at the SM Mall of Asia Complex.

New Retail

For the upcoming year, an omnichannel approach is looking to be the norm. Instead of retail vs. e-commerce, people will learn about a brand through combined efforts both online and on-ground. Retailers will need to strengthen their e-commerce and social media game as well, with 65% of Filipinos researching the brand through these mediums, according to Global Web Index.

Robinson’s Galleria took this particular approach in marketing the country’s first digital playground, PlayLab. They relayed information to the public through a seamless interplay of both traditional and digital channels. People can encounter PlayLab through lifestyle articles, blog reviews, social media posts, and app bookings.

Media Meter offers media monitoring services in the Philippines to know how the media is talking about your brand and track your digital mediascape. Contact us for inquiries or view our monitoring reports.